منتجات خط إنتاج زيت جنين الذرة في ليبيا

زيت جنين الذرة (Zea mays) زيت جنين الذرة هو منتج ثانوي لعملية طحن زيت الذرة. يتم استخدام معظم الذرة التي يتم حصادها كعلف ولكن نسبة الذرة التي يتم حصادها

يتم استخراج زيت جنين الذرة فوق الحرج عند ضغوط تتراوح بين 34-55 ميجا باسكال ودرجة حرارة ثابتة تبلغ 50 درجة مئوية. أسفرت التجارب التجريبية عن زيت بجودة أعلى مع الحد الأقصى

مصنع إنتاج زيت جنين الذرة النفط الخام ليبيا

تغطي إمدادات مصافي النفط المحلية وإنتاج الغاز المحلي معظم الطلب الأساسي على الطاقة في ليبيا. ويستهلك ما يقرب من 60% من السكان زيت الذرة:

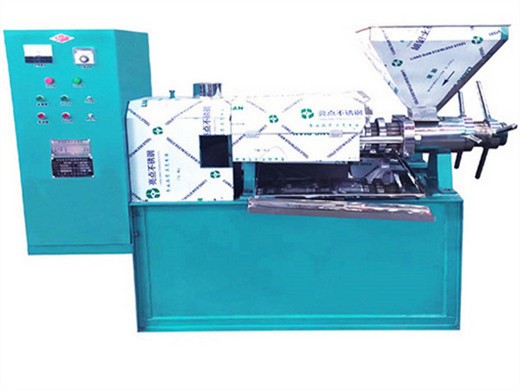

الوظيفة: إنتاج زيت فول الصويا؛ الخبرة في التصنيع: حقل زيت صالح للأكل؛ الأداء: ممتاز؛ المادة: فولاذ؛ الميزة: توفير الطاقة؛ شراء مجموعة كاملة من الذرة

خط إنتاج زيت جنين الذرة في شركة Zhengzhou Siwei للحبوب والزيوت

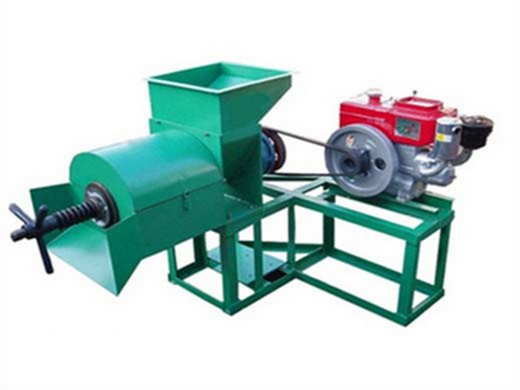

نظرة عامة على خط إنتاج زيت جنين الذرة: 1. آلة إنتاج زيت جنين الذرة المتقدمة، مع مراعاة توفير الطاقة وحماية البيئة والطاقة الحرارية

استخراج زيت جنين الذرة بكفاءة وصديق للبيئة باستخدام محلول الإيثانول المائي بمساعدة انفجار البخار مركز PMC الوطني النوع: الضغط البارد والساخن

التجهيز الزراعي والخدمات والمنتجات الزراعية في ساحل العاج

بالإضافة إلى الكاكاو والكاجو، تعد كوت ديفوار مصدرًا صافيًا للمحاصيل النقدية الرئيسية التي يزرعها المزارعون الصغار والكبار بما في ذلك القهوة والمطاط والقطن وزيت النخيل،

آلة تكرير زيت جنين الذرة الخام في ساحل العاج. الاستخدام: زيت جنين الذرة؛ النوع: آلة تكرير زيت جنين الذرة؛ القدرة الإنتاجية: 210-30 كجم/ساعة، 50-700 طن/24 ساعة؛ الطاقة (وات): 2000

مذيب خط إنتاج عصر جنين الذرة 500 طن يوميا

خط إنتاج عصر بذور الذرة 500 طن في اليوم، ابحث عن التفاصيل والسعر حول آلة إنتاج زيت بذور الذرة من مصنع الاستخلاص بالمذيبات من عصر بذور الذرة 500 طن في اليوم

1. يمكن للخط الكامل الأوتوماتيكي أن يوفر العمال، ويمكن لشخص واحد أن يكون متاحًا في المختبر للتشغيل. 2. معالجة وظيفية كاملة مثل تنظيف القمح والذرة والذرة وتقشير الذرة وطحن القمح والذرة والذرة إلى قمح وذرة

- What is the difference between Form 5500 & 5500?In contrast, Form 5500 generally applies to any employee benefit plan that contains 100 or more participants. This larger filing requires schedules and attachments in addition to the Form 5500 to be filed each year. Who Files Form 5500? The administrator of an employee benefit plan is ultimately responsible for filing the relevant Form 5500.

- What is IRS Form 5500?By Dr. Jim Dahle, WCI Founder IRS Form 5500 is an information-only return that must be filled out by 401 (k) administrators. Many small business owners are also de facto 401 (k) administrators, and they may be required to fill out this form.

- What is a Form 5500 audit?“The Form 5500 series and audits are important compliance, research and disclosure tools for the DOL and a source of information and data for use by other federal agencies, Congress and the private sector in accessing employee benefit, tax and economic trends and policies,” Foster says.

- What is a Form 5500 401(k)?Form 5500 is filed with the DOL and contains information about a 401(k) plan's financial condition, plan qualifications, and operation. The purpose of the form is to provide the IRS and DOL with information about the plan's operation and compliance with government regulations.